🌏 Bitcoin: What's the Environmental Impact?

Morning all,

We’ve all heard of Bitcoin - but how many of us understand what it actually is and where it came from?

When it comes to cryptocurrency, the cost of it is often and understandably discussed in monetary terms - but what about the reported environmental cost?

Some are concerned that it uses up colossal amounts of electricity, while others argue it is primarily renewable energy.

While we don't claim to be crypto experts, we are keen to share what we learned in our research in recent weeks.

Until Monday,

Your Fixers

WHAT IS BITCOIN?

Bitcoin is a digital currency - and was designed with the goal of being a digital replacement for traditional money.

People who own Bitcoin can use specific websites to exchange it for goods and services, or even convert it into physical currencies - such as US Dollars or Euros.

Globally, more than 15,000 businesses accept Bitcoin - and there are in excess of 5,000 Bitcoin ATMs, where one can buy and sell the digital currency.

Every day, more than 328,000 Bitcoin transactions are processed.

HOW DID IT BEGIN?

In 2008 - the same year as the global financial crash - a paper was published, arguing traditional currencies were too reliant on trusting third parties, including banks.

The launch of Bitcoin was in part a response to this - and its decentralised design renders such institutions irrelevant.

While there are now said to be more than 8,000 cryptocurrencies in existence, Bitcoin is widely considered the most valuable and well-known of them all. Ethereum ranks second.

WHO STARTED IT?

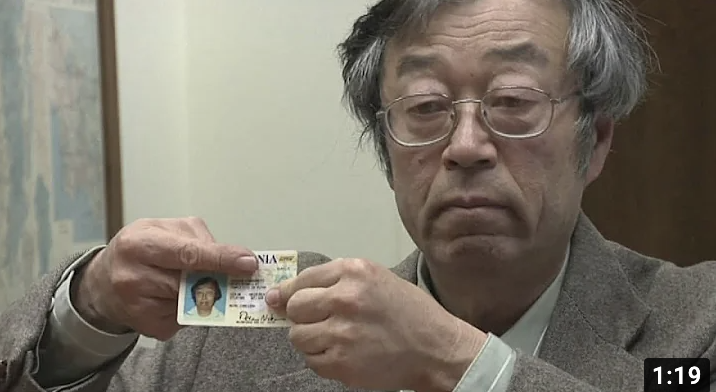

Bitcoin was created in 2009 by the highly elusive ‘Satoshi Nakamoto’. Nobody knows for absolute definite who that is - in fact, for years many have wondered if it is even a single individual.

There has been so much mystique around Nakamoto that a statue in Budapest shows a blank face made of bronze, where everyone sees their own face reflected back to them.

Is there any speculation to who it could be?

Well, back in 2014 a lot of guesswork pointed to Nakomoto being a 64-year-old Japanese-American man named Dorian S Nakamoto. He is a retired physicist based in LA, who has strongly and repeatedly denied any involvement in Bitcoin.

What makes the mystery even more interesting is the fact that an Australian entrepreneur - called Craig Wright - has been claiming since 2016 that he is Nakamoto.

Those claims have been met with considerable skepticism, with Forbes magazine even once describing it as a "hoax".

The Financial Times in 2016 said Wright wanted his peers to believe him "without the cryptographic proof needed". They say it could have been proven rather easily, by moving funds from Satoshi's original Bitcoin.

Despite this, in 2019 Wright - who is based in the UK - used libel law to silence those refuting his claims.

Wright made headlines again in December 2021, when he won a civil trial against the family of a deceased former business partner. The family alleged the pair had co-created Bitcoin together, and as a result believed they were owed half of the Bitcoin fortune.

Wright repeatedly said that if he won the trial - which he did - he would prove he is Satoshi Nakamoto.

Whoever it is, as of November 2021 Satoshi Nakomoto was the 15th wealthiest ‘person’ in the world - with a net worth of up to $73 billion.

SHADY ACTIVITIES?

Bitcoin is largely free of regulation - and transactions made using the currency are difficult to trace. As such, it has been used for "shady activities" - such as purchasing illicit goods.

A study in 2019 found that more than a quarter of Bitcoin users - and almost half of Bitcoin transactions - were related to illegal activities.

This amounts to approximately $76 billion worth of illegal activity involving the use of Bitcoin each year.

However, the share of illegal activity is declining as Bitcoin enters the mainstream. By skipping out middle men - like credit card companies and banks - the digital currency is an easier, quicker and cheaper way of paying for things, and an efficient way to move money internationally.

THE VALUE OF BITCOIN

Since the introduction of Bitcoin, its value has fluctuated massively - rendering it unstable. This can mean substantial returns for investors - but also poses significant risk.

Rewind to August 2010 and one Bitcoin was worth $0.05. Nine months later in June 2011, its value had increased to $30, but within six months had slumped back down to $4.25.

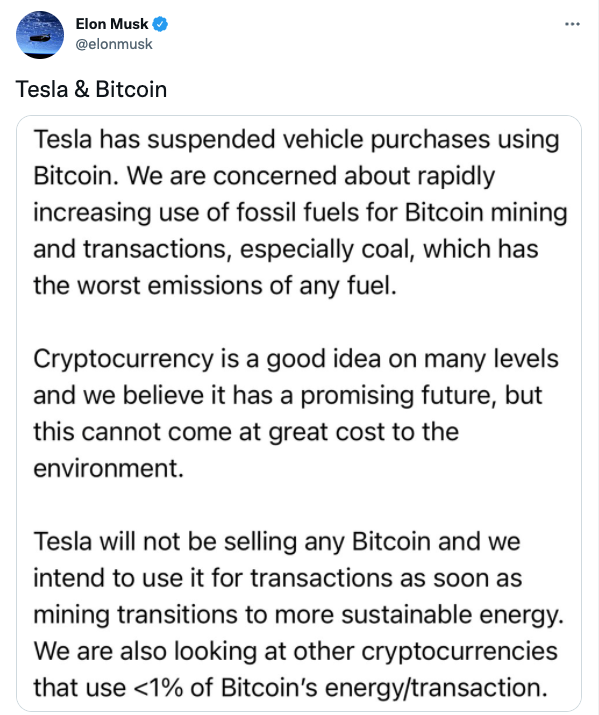

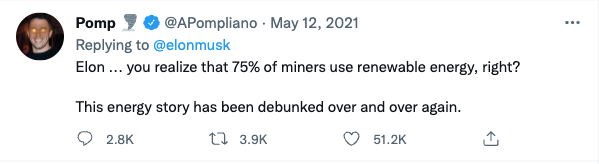

In the past year, the digital currency has also been vulnerable to tweets from Elon Musk - ranging from a 14% surge, to a fall of more than 7%. While Musk's Tesla initially said it would accept Bitcoin payments, they rolled back on this in May, citing concerns for the environmental impact.

The announcement hugely divided opinion, and sent the value of Bitcoin tumbling.

The value has since decreased, and earlier this month Bitcoin was in “freefall” - with its value plummeting 10% in 24 hours, to around $38,000.

In part, this was due to ongoing concerns over the economic impact of a potential Russian invasion of Ukraine - with investors selling off riskier assets. Other factors include potential interest rate increases in the US and the impact of the Omicron variant on markets.

To talk about Tesla's reasons for rolling back on accepting Bitcoin payments, we have to explore the process of how new Bitcoins get 'created'.

MINING BITCOIN

Well, it’s all quite technical really - owning and trading Bitcoin is one thing, creating new Bitcoin is another.

Put simply, there are a finite number of Bitcoins, with an estimated 88% already created. New Bitcoins are constantly being created by users using special software on their computers. This is a process known as ‘mining’.

The way mining works is that roughly every ten minutes there's a new block of Bitcoins, and the entire network holds a sort of lottery. To enter it, your computer has to try and work out a very difficult and useless mathematical calculation.

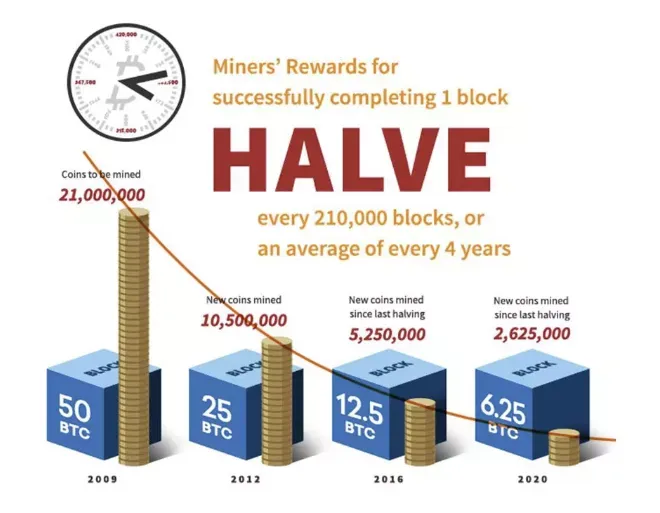

When Bitcoin started, one block equalled 50 bitcoins. By design, the number of bitcoins per block is reduced by 50% about once every four years. So as of May 2020, this had decreased to 6.25.

As of January 2022, 18.9 million bitcoins had already been issued, with about 2.1 million bitcoins still to be released. The maximum total supply of Bitcoin is 21 million.

Anyway, the difficulty of the mathematical calculation gets adjusted, so no matter how many people around the world are trying to find the answer, it will get solved roughly every ten minutes. At which point a new problem will be generated.

Solving the calculation shows you have used electricity - creating ‘proof of work’. It also ensures the supply of Bitcoins is restricted and grows at a steady rate.

It is believed new coins will stop being created in around the year 2140. After this point, Bitcoin revenue will be almost entirely from transaction fees.

GET RICK QUICK?

If your computer solves the calculation, you win the ten minute lottery - and will receive six brand new Bitcoin. Going by today’s value - that’s more than £165,000.

But before you get too excited, your home computer won’t be powerful enough to mine new Bitcoin. Well, it would have been back in 2010.

Today you need serious computing power if you want to solve the increasingly complex calculation and receive new Bitcoin. The sharp rise in the value of Bitcoin has encouraged intensive mining, and nowadays you even have many purpose built crypto mining farms.

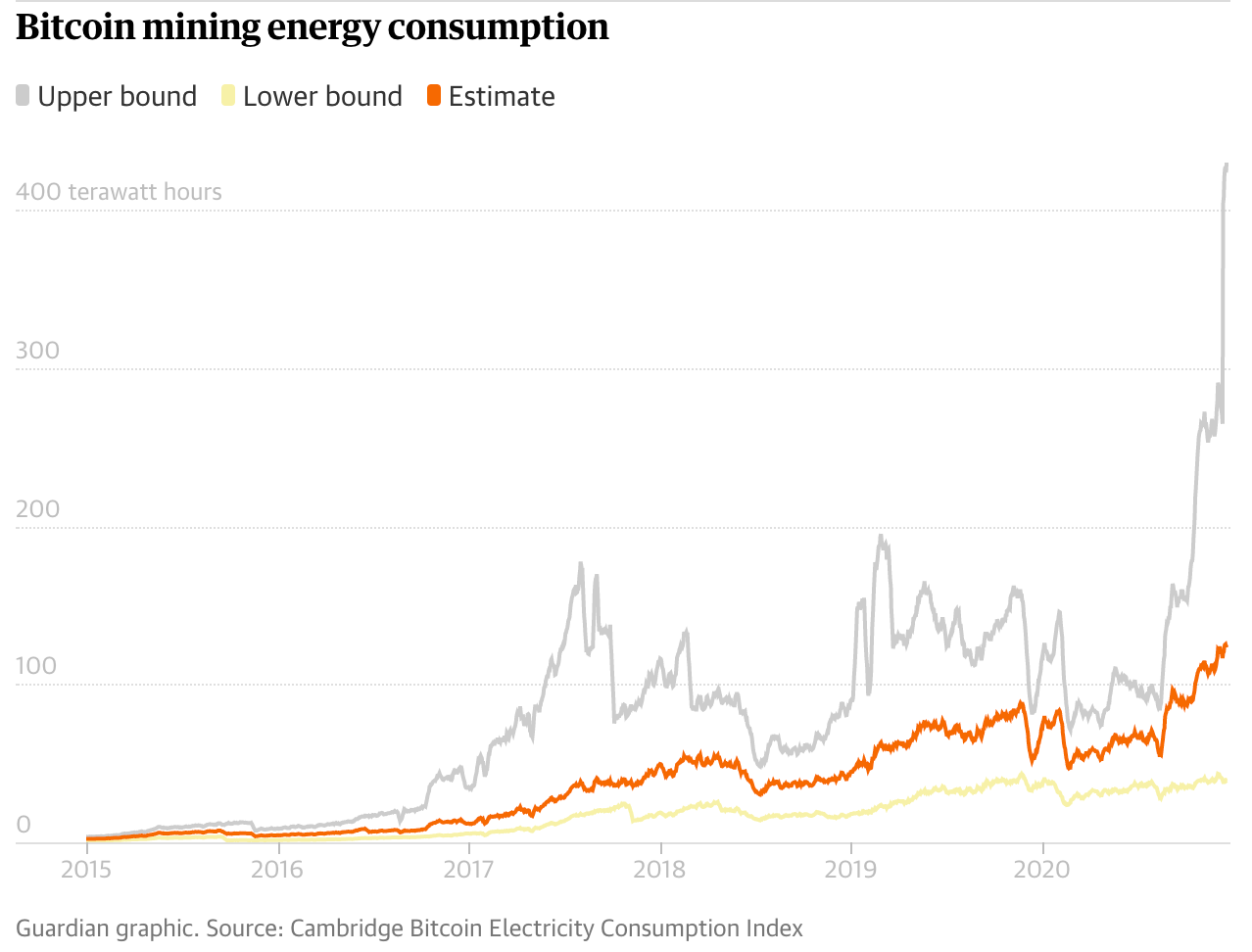

The graph below by The Guardian highlights the significant increase in the amount of energy being used to create new Bitcoins from 2020.

Purchasing and selling existing Bitcoin is simple and can be done with a home computer or smartphone. You can also make money through this too. But it is creating new Bitcoin (mining) that is complex - and the most lucrative.

ENERGY USAGE

As mentioned, it is this ‘mining’ that uses vast amounts of electricity. Purpose-built supercomputers are in operation around the clock, trying to solve the calculations to create new Bitcoin. These computers and the need to cool them down use a stunning amount of power.

How much? Well, worldwide mining efforts use around £200,000 worth of electricity every ten minutes. When you scale that up, Bitcoin uses two and a half times the energy per year as Amazon, Apple, Facebook, Microsoft and Google combined.

That is about the same amount of electricity per year as Norway. Overall, the Bitcoin industry releases 60 million tonnes of CO2 annually - which is equivalent to around nine million cars.

All this electricity means that mining one Bitcoin has an equivalent carbon footprint to two million visa transactions.

RENEWABLE ENERGY?

Bitcoin does use a remarkable amount of energy - but much of this is renewable sources. It is really difficult to quantify just how much, with estimates from different studies ranging between 39% and 73%.

Very few industries can claim such a high proportion. Though it is of note that all this data is self-reported, which is unverifiable.

As The Harvard Review pointed out, even if it was the lowest estimation of 39%, "that’s still almost twice as much as the U.S".

At one point this meant that up to 75% of the world’s total renewable energy was being used by Bitcoin - but this also meant less clean energy available for factories, businesses and homes.

WHERE IS BITCOIN MINED?

Much of the mining was taking place in China, where the government vastly overbuilt its hydropower programme.

As such there was lots of excess energy, and it was being used for lucrative Bitcoin mining. At one point, 75% of the Bitcoin mining took place in China.

However, last year Beijing cracked down on the use of hydropower for this purpose - in part because the country is now dealing with an energy shortage.

While up to 20% of the world’s bitcoin mining remains underground in China, much has moved abroad.

KAZAKHSTAN

As Beijing pushed out many of its Bitcoin miners, they moved to other countries including neighbouring Kazakhstan - a popular destination, largely due to its low energy prices. As such, Kazakhstan became the world’s second-biggest country for Bitcoin mining, after the US.

However, at the beginning of the year civil unrest in the country sparked by rising energy prices led to the value of Bitcoin falling by eight percent - as the country lost much of its internet access. These events illustrate the high volatility of the digital currency.

LEGAL TENDER

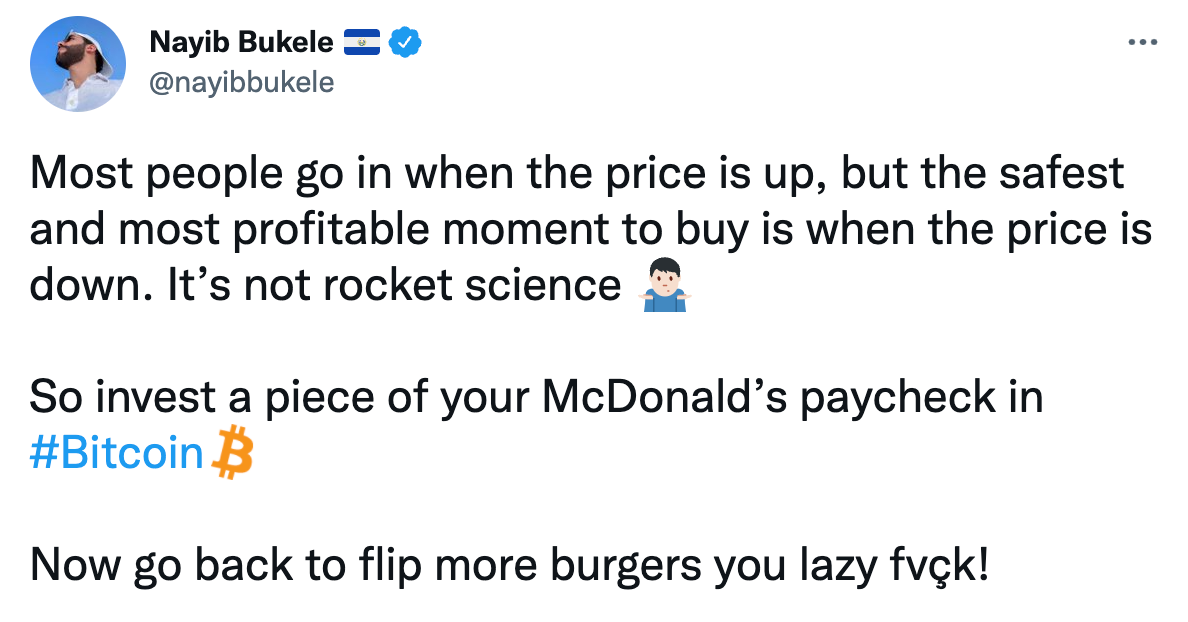

In November 2021, El Salvador became the first country in the world to begin using Bitcoin as legal tender. The plans were spearheaded by the country’s President Nayib Bukele - who goes by the title ‘CEO’ and doesn't exactly filter his opinions.

Bukele has already invested tens of millions of public funds purchasing Bitcoin - which has recently meant significant financial loss due to a downturn in value.

The decision to adopt Bitcoin as legal tender has been criticised by the IMF, who cited “large risks” in financial stability and consumer protection.

But despite this, the country still plans on building a Bitcoin city - shaped like a coin - at the base of a volcano where it will mine Bitcoin using renewable geothermal energy.

FOSSIL FUELS

Even if some of the power used for Bitcoin mining is renewable, the majority of studies suggest more than half of it is still said to be sourced from fossil fuels. In Kazakhstan and elsewhere in Asia, most Bitcoin operations are powered by coal.

Adding to this, in North America Bitcoin miners are paying oil companies to use the gas produced from their drilling activities to power their computers. On the one hand, this saves the gas from being burnt into CO2 or being released as methane.

On the other, the practice fails to eliminate emissions, and instead transfers them. The profitability de-incentivises oil companies to find other - less damaging ways - to get rid of gas.

THE LONGER TERM

For now intensive mining for Bitcoin looks set to continue - but as we mentioned 88% of Bitcoins have already been created. After the final new Bitcoin is created around the year 2140 , the dynamic will change.

At that point instead of mining, most revenue will come from users paying to use the network - almost certainly meaning Bitcoin will require less electricity.

As its energy use changes - the longer-term impact of Bitcoin on the global financial system is unclear. Some people genuinely think Bitcoin is the future, others are worried it could destroy the economy.

Equally some argue that if we can get Bitcoin to work - by continuing to skip out the ‘middle men’ of banks and governments, and by slashing the power the currency uses - our economy could be transformed for the better.

In terms of our Instagram community, roughly a quarter of you have bought or sold a cryptocurrency before, yet nearly two-thirds did not know about the level of energy required for the mining process to create new Bitcoin.

We hope you found this to be a helpful and interesting read. If you enjoy NewsFix, please make sure to tell a friend and help us grow this community! ✌🏽